Tuesday, June 21, 2016

Monday, June 20, 2016

Department of Telecommunication Recruitment 2016 For Various Posts Apply Here @ www.dot.gov.in

Department of Telecommunication Recruitment 2016 : Department of Telecommunication has invited applications from the interested and eligible candidates. It has released the official notification for the recruitment of 97 various post. Interested candidates can apply here. For more details like age limit, education, pay scale, application fee and more scroll down and check at the bottom of the page. To make it simple for you to apply we have provided with a link. Simply click on the link to apply.

Department of Telecommunication Recruitment 2016 For Various Posts Apply Here @ www.dot.gov.in :

Recruitment details :

Name of the Organisation : Department of Telecommunication Recruitment 2016

Name of the Post : Senior Accounts Officer, Assistant accounts Officer and many other Post

Number of Posts : There are total of 97 posts.

Job Location : Maharashtra

Educational Qualification : Candidates should have Junior AAO’s/ AO’s on regular basis from a recognized university. Check the detailed notification for more information.

Pay Scale : Candidates will be paid as per the post.Check the notification for pay scale details.

Application Fees : Check the detailed notification for application fee information.

Selection Process : Candidates will be selected based on personal interview for the selected candidates. For more details check official notification.

How to Apply : Candidates should apply by sending application form to the committee on or before last date. Apply with true information and send the printout off application form to the mentioned address.

Address : Department of telecommunications, Office of the Pr.Controller of Communication Accounts, Maharashtra C-Wing, 3rd Floor, Administrative building, Juhu Danda, Telecom Complex, Juhu Danda Road, Sanacruz (West) Mumbai – 400054.

Important Dates :

Last to send applications is 16 July 2016.

Detailed Notification : Click Here

Application Form : Click Here

Official Website : Click Here

For more details stay in tune with us. We will update more information regarding recruitments and results. We will update exam date as soon as possible.

Thursday, June 16, 2016

Beware ! Customer cheated the Employee of CBS Post Office

Beware ! Customer cheated the Employee of CBS Post Office

A customer comes to post office and presents his passbook with withdrawal form. CPA invoke the CTM menu, fill Account No. and check balance of Customer. There is sufficient balance in his account. So CPA proceeds the withdrawal and hand over the Rs 13000/- rupees to Customer. After receiving the money a black play starts by customer. A relative of customer is standing at ATM. As customer informs quickly to his relative to withdrawal money, relative makes three transaction, two of Rs 6000 and one of Rs 1000 in micro second. This balance of account goes down. This ATM withdrawal activity starts before Transaction verification.

Now Supervisor start to verify the transaction. He is shocked to see that there is not sufficient balance in account. In this situation what can do CPA or Supervisor because it is single hand office. He can't fill FIR to police because our department is not so cooperate to help him for this doing. CPA comes to Customer home and say please return money because your account has not sufficient amount and you withdrawal the amount from ATM. He replies that my ATM has been lost and I have already inform your department. I don't know anything. This is your work to find who withdrawal the money from ATM.

This event is so sad full to our employee who is not aware of this mischievous activity. The event happened at MNIT Post office Jaipur.

FinacleSolution Team advice to all viewer please give money to customer when you complete the verification process and fully satisfied to check his passbook balance on HACLI. We don't want to repeat this black paly with any other employee. The amount Rs13000/- is not so big but many of us has liability. So this amount is huge due to penalize him for tally that day daily account

SB TO RD SI ENTRIES IN DOP FINACLE

Standing Instruction In DOP Finacle

- Standing instruction in DOP Finacle can be given from SB account to RD account by using the menu HSSIM menu.

- HSSIM stands for Standing Instruction Maintenance.

- Note that for giving the standing instructions from TDA accounts(SCSS,MIS and TD) accounts to SB accounts we should not use this menu.

- For giving the standing instructions for TDA accounts(SCSS,MIS and TD) accounts we have to go for account modification menu and enter the interest credit account as SB account number of the customer and submit and verify in the supervisor.

- For giving the standing instruction from SB to RD invoke the menu HSSIM and select the function as "ADD" then click on Go as shown

Then the system will ask to enter the following in the header details

- Select the Standing Instruction Type as "customer induced"

- Enter the CIF Id of the customer in the field CIF ID.

- Select the Standing Instruction Frequency as Monthly,date and Previous day as shown

- Select the field execution time as "B-after change of Date"

- Enter the filed Next execution date as "give the next execution date" as shown in the figure

Then click on instruction details then the system will ask to enter the following

Debit Entry

- Select the CCY filed as "INR"(Indian Rupee)

- Enter the account id of the customer "SB account number of the customer"

- Select the amt type field as "Fixed"

- Select Debit/Credit field as "Debit"

- Enter the amount field "as amount of RD amount" as shown

Then click on Add as shown then the system will ask to enter the following

Credit Entry

Select the CCY filed as "INR"(Indian Rupee)

Enter the account id of the customer "RD account number of the customer"

Select the amt type field as "Fixed"

Select Debit/Credit field as "Credit"

Enter the amount field "as amount of RD amount" as shown

- Then finally click on submit then the system will generate the standing instruction number as shown

- Then note down the instruction number and verify the same in the supervisor.

COURTESY:POFINACLE GUIDE

Comparison of SB Account Charges in India Post V/s Nationalize Bank

A Comparison of SB Account Charges in India Post V/s Nationalize Bank

Now the analysis prove that facilities of India Post are cheaper than any other Bank. This is a satisfaction conclusion that we facilitate our customer with high class services at lower charges.

CBS Finacle Work Flow Process With BO Transactions

Monday, June 13, 2016

Error of Unverified Accounts exits in DSA while Modification

Many time we have to modify agent due to various reason i.e. Expiry Date, New Product Add. If agent has unverified accounts. The error "Unverified accounts exists for the direct selling agent under [Scheme]" is coming at the time of modification.

This error shows some accounts which have been opened but not authorized. This accounts may be opened twice when error of "could not get response from server" and remaining without verification. We can see the list of unverified in HDSAMM menu. The procedure is given below:-

- Function - I-Inquire

- DSA ID

- GO

- The respective screen will be appeared.

- Click on Inquiries TAB

- Select Related Accounts Number

- GO

- Now the next screen will be appeared.

- Select No in V-Verify as seen in screen shoot.

- The list of unverified accounts will be displayed

- These accounts have to be either verify or cancel in HOAACVTD command.

- The Procedure of using HOAACVTD is given in my earlier post.

Saturday, June 4, 2016

Postal Department's Payments Bank To Employ About 3.5 Lakh People: Ravi Shankar Prasad

Prasad has asked Department of Posts to hasten process of setting up all 650 payments bank branches by September 2017.

Telecom Minister Ravi Shankar Prasad Thursday asked Department of Posts to hasten process of setting up all 650 payments bank branches by September 2017.

"Minister (Prasad) today met Postal Services Board for India Post Payments Bank and asked them to expedite the process of setting up this entity by September 2017 as desired by Prime Minister Narendra Modi. There will be about 3.5 lakh employees who are being trained in phases," an official source told PTI.

The Union Cabinet on Wednesday cleared proposal to set up India Post Payments Bank with a corpus of Rs 800 crore and has plans to have 650 branches operational by September 2017. It will be expanded further scaled up to cover the entire country by the end of financial year 2018-19.

Earlier, the Department of Posts (DoP) had to set-up 650 IPPB branches in three years.

With advancement of target, DoP will set up 50 branches by March, 125 by April, 200 in May, 300 in June, 400 in July, 525 in August and 650 by September.

"The Minister (Prasad) will hold review meetings every fortnight," the source said.

Initially most of the 3.5 lakh workforce will be posted on deputation who will be gradually replaced by fresh recruits.

Prasad has asked postal department to hire MD and CEO of the IPPB by August and set up selection committee for hiring Chief Financial Officer by June 15.

The minister has also advance dates for giving handheld devices to 1.3 lakh grameen dak sevaks.

"He has asked the Department of Posts to start rolling out handheld devices in from June 15 and finish the process by in next 3-4 months," the source said.

The IPPB will be managed professionally and most of its A grade employees will be hired from market. The IPPB board will have representation from various other government departments including the Department of Posts, Department of Expenditure, Department of Economic Services etc.

Government has approved Rs 800 crore corpus for IPPB which will have Rs 400 crore equity and Rs 400 crore grant.

NJCA MEETING HELD TODAY EVENING & DECIDED TO SERVE STRIKE NOTICE

NJCA MEETING HELD ON 3.6.2016 EVENING

DECIDED TO SERVE STRIKE NOTICE ON 09th JUNE 2016.

INDEFINITE STRIKE WILL COMMENCE FROM 11th JULY 2016.

DTAILS WILL FOLLOW

(M. KRISHNAN)

SECRETARY GENERAL

CONFEDERATION

|

NO RECORDS FETCHED WHILE WITHDRAWING MIS/TD/SCSS INTEREST AMOUNT IN DOP FINALCE

Issue Reported:

Unable to pay MIS/TD/SCSS interest amount from Sundry Account.

Solution:

The recommended sequence to be followed by the user:

1. Check the interest amount generated and interest already paid using HTM :

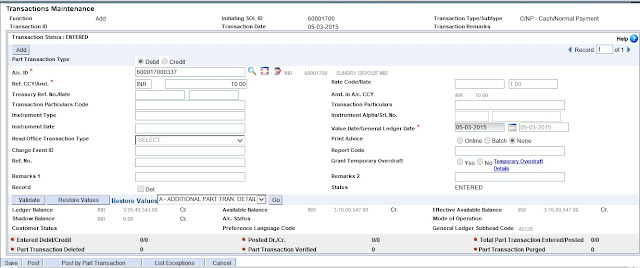

HTM --> Add --> C/NP --> Sundry account as Account Id --> any amount --> Click on Additional part tran details --> Go

Give no values to Start and End amounts, and no values to Start and End Date -->Filter as Select-->Ref No as MIS Account Number--> Submit

interest generated amount will be displayed under 'Tran. Amt.' and interest paid to the customer will be displayed under 'Reversed Amt.'

- If a generated interest has already been paid to the customer, that reversal transaction can be viewed by clicking on the icon under 'Contra Tran Details' :

- The 'Contra Part Transactions List' window gives the transaction details. By Clicking on the icon under the first Column, further details of the reversal transaction can be obtained:

2. If the interest amount generated is not reversed, then the user may payout the generated interest amount

Subscribe to:

Comments (Atom)